AP Photo/Hans Pennink

Welcome to Insider Cannabis, our weekly newsletter where we're bringing you an inside look at the deals, trends, and personalities driving the multibillion-dollar global cannabis boom.

Sign up here to get it in your inbox every week.

Happy Friday,

I'm typing away ahead of a week of vacation in Italy. It's my first time here, so get in touch if you have recommendations – or don't because I probably won't be checking my phone or email too much.

On that note, it was another whirlwind week in the cannabis world, with tons of companies reporting financial results and deals galore.

The quick highlights: Eaze is getting into Colorado and Florida by acquiring Green Dragon, a chain of dispensaries. We got the scoop on the deal and the company's plans to raise $75 million.

Shortly after we put up a fiery interview with Green Thumb Industries CEO Ben Kovler, Tilray made a push into the US by buying up a chunk of MedMen's debt.

Kovler said it's misleading when Canadian cannabis execs tout their US ambitions since they can't actually sell cannabis in the US.

I won't spoil the story here, but Tilray CEO Irwin Simon pushed back on Kovler's comments in an interview. Tilray's deal is a convoluted one - and it'll take a lot of regulatory changes for Tilray to actually take a majority stake in MedMen.

Other US cannabis execs told us they're not worried about their Canadian rivals, though some did signal that interest in US cannabis can, in a way, benefit everyone involved.

Last but not least, take a look at our second list of the top dealmakers in the cannabis industry.

Other cannabis happenings:

Trulieve CEO Kim Rivers' husband JT Burnette was convicted on five charges, including extortion, The Tallahassee Democrat reports. Burnette was caught on tape bragging about using his access to manipulate Florida cannabis licensing rules in Trulieve's favor.

Rivers released a statement denying any wrongdoing on her or Trulieve's part and added that the company's board is in full support of her leadership.

You'll all be in good hands with Yeji next week!

- Jeremy Berke (@jfberke)

If you like what you read, share this newsletter with your colleagues, friends, boss, spouse, strangers on the internet, or whomever else would like a weekly dose of cannabis news.

Here's what we wrote about this week:

The CEO of a top US cannabis company unloads on his Canadian rivals: 'Dissuading, misleading, and lying to investors'

Green Thumb CEO Ben Kovler isn't scared of his Canadian rivals' plans to jump into the US. Canadian companies like Tilray and Canopy Growth have made their US ambitions clear in recent weeks.

Cannabis startup Eaze is raising $75 million in a push to make deals and dominate retail

Eaze is raising $75 million and buying Green Dragon, a dispensary chain, the company told Insider.

Eaze has pivoted from a delivery company to one that also sells and operates cannabis stores. With the acquisition, Eaze is pitching itself to investors as a multistate operator like Curaleaf or Trulieve.

Canadian cannabis giant Tilray is using a convoluted deal with one of the most troubled US cannabis companies to enter the $100 billion US market

Canadian cannabis giant Tilray made a deal with MedMen to gain a foothold in the US. Tilray is buying some of MedMen's debt, which would turn into equity once the US legalizes cannabis.

Wall Street is making a killing on cannabis. Here are the top bankers raising money, cutting deals, and raking in millions.

Wall Street banks have pulled in over $577 million in fees from cannabis deals since 2017. Canaccord Genuity, a midsize investment bank in Canada, leads the pack, while Goldman Sachs is a distant second.

The manager of a $900 million cannabis ETF names the 'underloved' pot stock that investors should take a close look at now

Dan Ahrens, the manager of a $900 million US cannabis ETF says Verano Holdings is an underloved US cannabis stock. The company, which went public earlier this year, trades at a discount to its peers. Ahrens lays out why it might be a good time to get in.

Canadian cannabis companies have declared they're coming for the US, but their American counterparts say they're not worried

Canadian cannabis giants are bullish on the US market, so they're making deals that could give them an edge.

But the CEOs of the largest US cannabis companies told Insider they're far from worried.

AP Photo/Matilde Campodonico

Executive moves

- The Parent Company said on Monday that Troy Datcher would be joining as CEO.

- Valerie Malone is joining Canadian cannabis firm HEXO as chief commercial officer.

- Nilyum Jhala, the former vice president of global and digital technology at Hallmark Cards, will become Trulieve's chief technology officer, the company said.

- Francesca Serraino Fiory, a veteran of Perrigo, Pfizer, and J&J, is joining Green Hygienics as chief science officer.

- Aaron Riley is leaving his role as CEO of cannabis testing lab CannaSafe, as part of a broader reorganization of the company. He'll be replaced by Gerry Dabkowski.

- The US Cannabis Council, an industry trade group, made a pair of senior hires: Bo Bryant and Josh Glasstetter are joining as VP of government relations and director of communications.

- Actress Rosario Dawson is joining cannabis beverage company Cann's board.

- Delta 9 appointed David Kideckel, formerly an analyst at ATB Capital Markets, as head of strategy, corporate development, and capital markets.

Deals, launches, and IPOs

- Tilray is buying a chunk of MedMen's debt. Read our analysis of the deal, including thoughts from both CEOs, here.

- PharmaCann, a cannabis company with a valuable New York license, is planning to go public on the Canadian Securities Exchange in a deal that could value it at $1 billion, Reuters reports.

- UK psychedelics company Beckley Psytech said it closed an $80 million Series B funding round.

- Canadian cannabis company Village Farms International is acquiring Colorado CBD company Balanced Health Botanicals in a transaction valued at $75 million.

- Ayr Wellness is buying Cultivauna in a $20 million cash-and-stock transaction. Cultivauna makes the cannabis-infused beverage brand Levia.

- Weedmaps and Kevin Durant are partnering up to reduce the stigma around marijuana use.

- Colombian cannabis company Flora Growth said it will acquire vape maker Vessel Brands. The companies did not disclose financial terms.

- Cannabis REIT NewLake Capital Partners is going public via a direct listing.

AP Photo/Chris Carlson

Policy moves

- Nearly half of US adults have tried marijuana, according to a new Gallup poll.

- New Jersey announced its first set of rules regulating the cannabis industry on Thursday. The rules favor local entrepreneurs over multi-state operators, NJ.com reports.

- Lawyers for a man sentenced to 22 years in prison for marijuana-related offenses are using Supreme Court Justice Clarence Thomas' comments on the inconsistencies of federal cannabis policy to make the case for compassionate release, Marijuana Moment reports.

Research news

- A study in the Journal of the Canadian Academy of Child and Adolescent Development found no marked increase in cannabis use among Canadian youth three years into legalization. The study's authors said legalization continues to offer positive benefits for public health.

Earnings, and more earnings

- MariMed released its Q2 results on Monday, reporting $32.6 million in revenue, and net income of $7.6 million.

- MediPharm Labs released its Q2 results on Monday, reporting C$5.1 million in revenue, and a net loss of C$11.8 million.

- RIV Capital posted its fiscal Q1 2022 results on Monday, reporting a C$30.4 million net loss.

- Auxly Cannabis Group reported its Q2 results on Monday, reporting C$20.9 million in revenue and a C$8.7 million net loss.

- The Parent Company released its Q2 results on Monday, reporting $54.2 million in revenue and a $10.4 million loss on an adjusted EBITDA basis.

- 4Front released its Q2 results on Monday, reporting $27.1 million in revenue and a net loss of $6.2 million.

- Greenlane Holdings released its Q2 results on Monday, reporting $34.7 million in revenue and a net loss of $5.8 million.

- Glass House Group released its Q2 results on Monday, reporting $18.7 million in revenue and a net loss of $4.7 million.

- Ayr Wellness released its Q2 results on Tuesday, reporting $91.3 million in revenue and an operating loss of $24.9 million.

- TerrAscend released its Q2 results on Thursday, reporting $58.7 million in revenue and a net loss of $23 million.

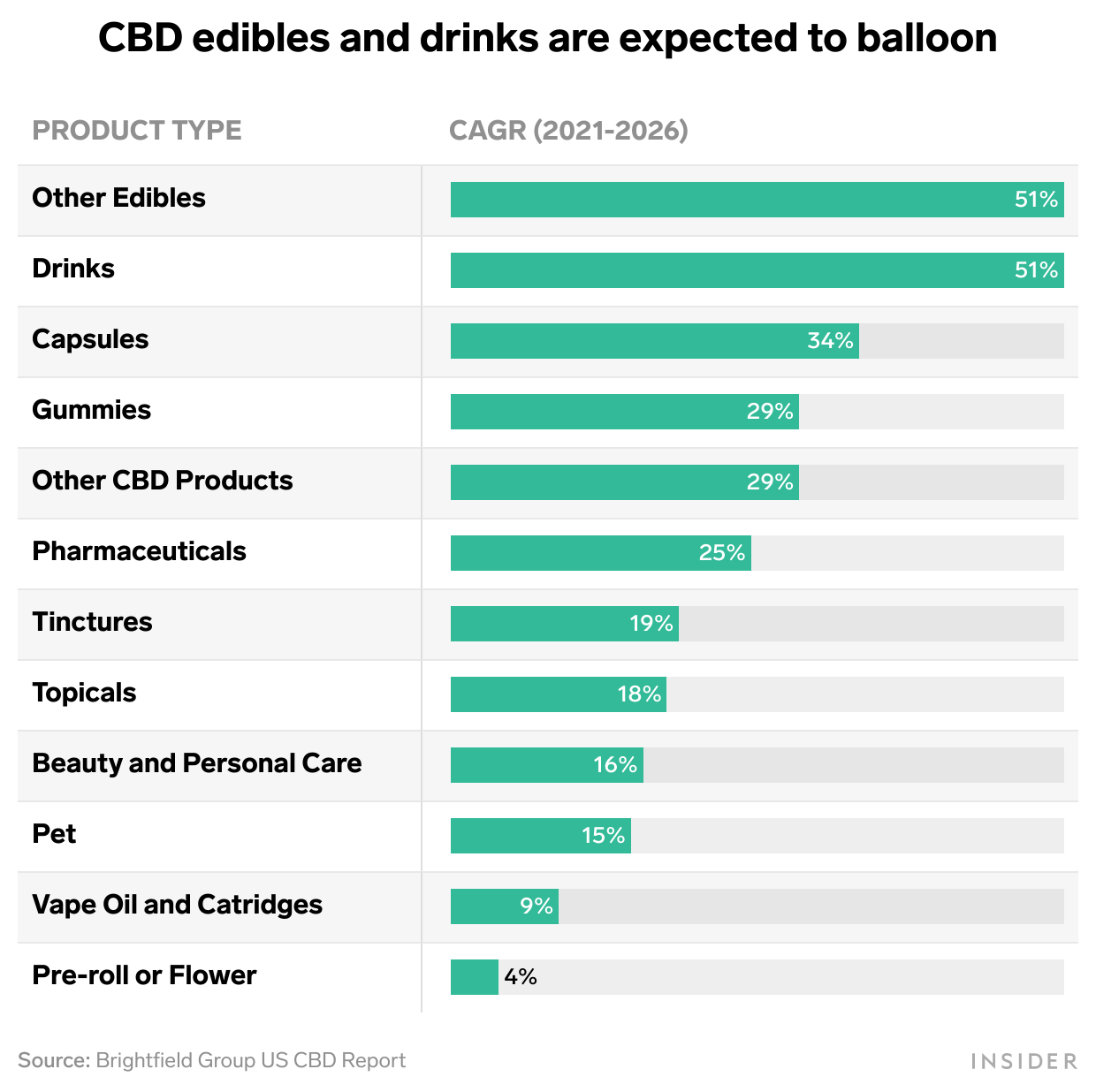

Chart of the week

The CBD market is expected to keep growing, according to data from Brightfield Group. Edibles and drinks categories are expected to have a compound annual growth rate of 51% over the past five years:

What we're reading

The Canna FAANG Cometh (Substack)

US cannabis insurers get ready to roll as federal legalization nears (Reuters)

Kevin Durant aims to destigmatize marijuana use with new partnership (ESPN)